Convoy of Hope and its partners have provided more than 200 million meals to those in need during the pandemic. Now, the IRS is providing incentives for those who have helped — and still plan to help — as Convoy provides for vulnerable communities around the world.

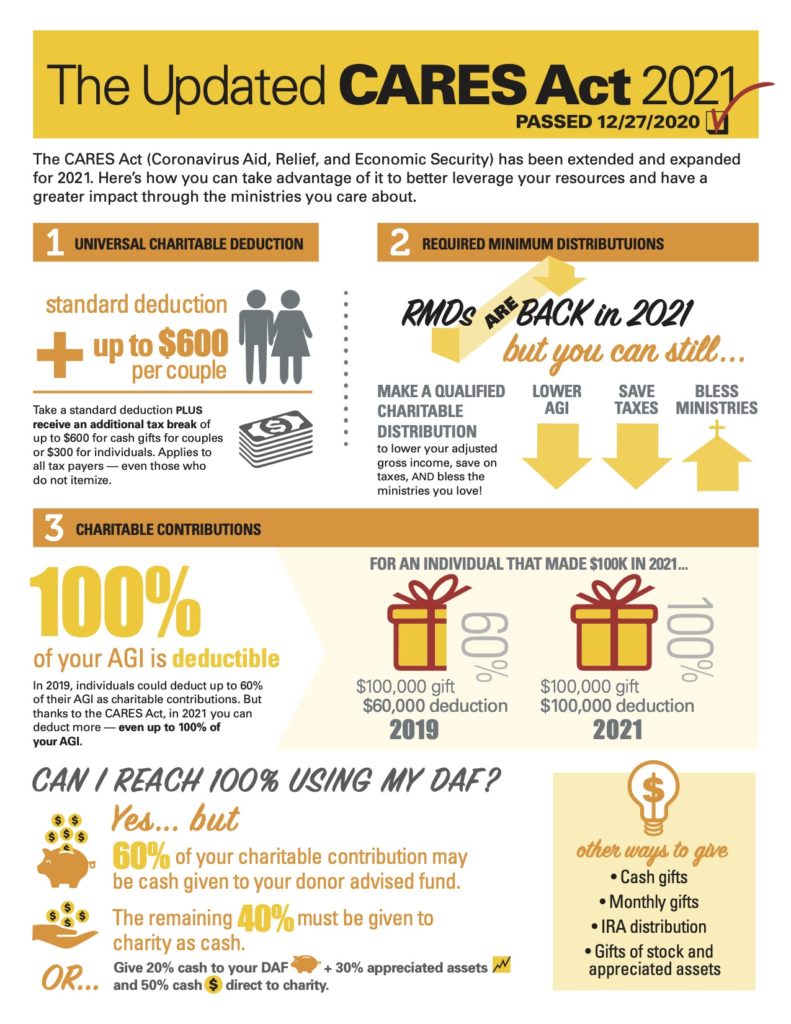

On March 25, 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act in response to the effects of COVID-19. The CARES Act is a $2.2 trillion economic stimulus bill, which allows people to give more money with greater tax savings than any time in recent history.

Perhaps the most significant part of the CARES Act is that donors may give up to an entire year’s worth of adjusted gross income and deduct 100% of it when properly structured.

There is never a wrong time to do good. But now more than ever, those who wish to help others through charitable donations may do so in a way that allows for mutual benefit between the donor and the recipient.

Contact your trusted financial expert to see if the CARES Act can help you provide for those in need. To contribute to Convoy of Hope in giving back to individuals and families around the world, click here.

Convoy of Hope considers it a blessing to help people around the world and is incredibly grateful for those who support this mission.