If you’ve been exploring the world of philanthropy and charitable giving, you may have come across the term “Donor-Advised Fund.” But what exactly is a Donor-Advised Fund?

A Donor-Advised Fund (DAF) is a philanthropic vehicle that allows individuals, families, or organizations to make charitable contributions, receive immediate tax deductions, and recommend grants to qualified nonprofit organizations.

When establishing a DAF, donors contribute assets such as cash, securities, or other eligible assets to a sponsoring organization.

While donors maintain advisory privileges over the funds, the sponsoring organization assumes legal control.

This structure grants donors the flexibility to support multiple charitable causes over time, while the sponsoring organization handles administrative tasks and investment management.

DAFs provide a streamlined, tax-efficient, and strategic approach to charitable giving, enabling donors to make a lasting impact on causes they care about.

In this article, we’ll dive deep into:

- • How Donor-Advised Funds work.

- • Their advantages and disadvantages.

- • How to set up a DAF.

- • Rules to keep in mind.

- • How they compare to other charitable giving vehicles.

So, let’s get started!

Donor-Advised Funds Pros & Cons

DAFs have gained popularity as a flexible and efficient tool for charitable giving. Like any financial vehicle, DAFs have their advantages and disadvantages.

Let’s explore the advantages and disadvantages of Donor-Advised Funds to help you make an informed decision about whether they are the right charitable giving option for you.

Advantages of Donor-Advised Funds

There are several benefits of Donor-Advised Funds for individuals and families who wish to make a meaningful impact through charitable giving.

Here are some key benefits.

Simplicity & Flexibility

Donor-Advised Funds provide a straightforward and flexible way to manage your charitable donations. You can make contributions to the fund and then recommend grants to your favorite charities over time.

Immediate Tax Benefits

By contributing to a Donor-Advised Fund, you can receive an immediate tax deduction for the full value of your donation.

This allows you to potentially reduce or eliminate capital gains taxes that would have incurred if they had sold the assets themselves. Once assets are contributed to a Donor-Advised Fund, they can grow tax-free.

Also, while the funds are held within the DAF, any investment growth or income generated by those assets grows tax free. This allows donors to maximize their charitable impact while minimizing their tax liability.

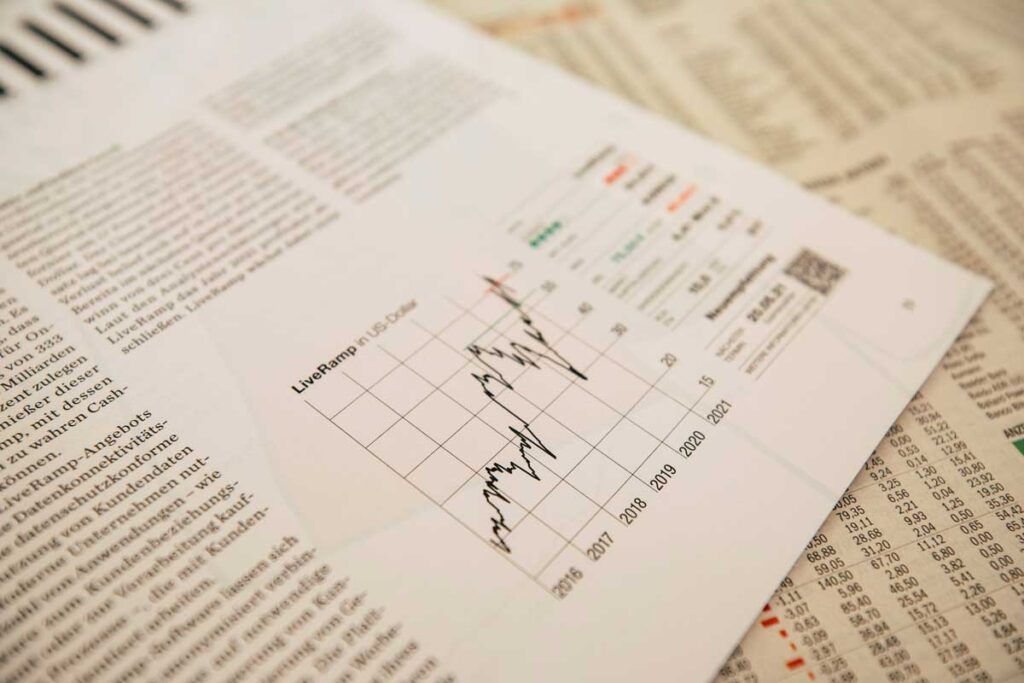

Utilization of Mutual Funds

When donors contribute to a DAF, they can choose from a selection of mutual funds offered by the fund provider.

These mutual funds provide diversification and professional management of the assets within the DAF, helping to potentially grow the funds over time.

Donors can select mutual funds based on their:

- • Risk tolerance.

- • Investment objectives or investment allocations.

- • Alignment with their philanthropic goals.

Long-Term Giving Strategy

Donor-Advised Funds enable you to take a strategic approach to philanthropy. You can contribute to the fund during high-income years and distribute grants to charities over time, even during a period of time when your financial situation might change.

Family Involvement

Donor-Advised Funds can involve multiple generations of a family in charitable giving. This can help instill philanthropic values in younger family members and create a lasting legacy of giving.

Donor-Advised Funds Disadvantages

While Donor-Advised Funds offer many advantages, it’s essential to consider the potential drawbacks as well.

Here are a few disadvantages to be aware of.

Irrevocable Contributions

Once you contribute to a Donor-Advised Fund, the assets become the property of the fund sponsor. While you can recommend grants, you no longer have complete control over the donated assets.

Investment Management Fees

Donor-Advised Funds often charge administrative fees and investment management fees based on the assets in the fund. These fees can vary among different fund sponsors and may impact the overall amount available for charitable grants.

You should review these fees when considering a DAF as it will impact the growth of your funds.

A note on excise taxes. DAFs are subject to certain excise tax rules imposed by the IRS. It’s important to consult with a tax advisor or financial professional to understand the most up-to-date excise tax regulations.

How to Set Up a Donor-Advised Fund (8 Steps)

If you’re looking for a powerful and efficient way to manage your charitable giving, setting up a DAF might be the perfect solution.

Let’s walk through the step-by-step process of setting up a Donor-Advised Fund, so you can begin your philanthropic journey with confidence.

Step 1: Research & Select a Fund Provider

The first step in setting up a Donor-Advised Fund is to research and select a reputable fund provider.

Consider factors such as:

- • The provider’s reputation.

- • Fees.

- • Investment options.

- • Customer service.

- • Any specific requirements they may have.

Step 2: Evaluate the Minimum Contribution Requirement

Each fund provider will have a minimum contribution requirement to establish a Donor-Advised Fund.

Evaluate the minimum contribution amount and ensure it aligns with your financial capacity.

It’s important to note that the minimum requirement can vary between providers, so choose one that suits your needs.

Step 3: Initiate the Account Setup Process

Contact your chosen fund provider to initiate the account setup process. They will guide you through the necessary paperwork and provide instructions on how to make your initial contribution.

Be prepared to provide personal information, such as your:

- • Name.

• Address. - • Social Security number.

- • Employer Identification Number (EIN).

Step 4: Make an Initial Contribution

Once your account is set up, it’s time to make your initial contribution to the Donor-Advised Fund.

This can be in the form of:

- • Cash.

- • Appreciated securities.

- • Other eligible assets.

Consult with your fund provider to understand their specific guidelines and any restrictions on acceptable contributions.

Step 5: Receive Your Tax Deduction

One of the significant benefits of Donor-Advised Funds is the immediate tax deduction you can receive for your contributions.

Consult with your tax advisor to understand the tax implications and guidelines specific to your situation.

Obtain the necessary documentation from your fund provider to support your tax deduction claim and maximize your tax returns.

Step 6: Recommend Grant Distributions

With your Donor-Advised Fund established and funded, you can now start recommending grants to eligible charitable organizations.

Research and identify causes or nonprofits that align with your philanthropic goals. Most fund providers offer an online platform or a designated process to submit grant recommendations.

Provide the necessary details, such as:

- • The charitable beneficiary’s name.

- • Your address.

- • The purpose of the grant.

Step 7: Grant Review & Distribution

After you submit your grant recommendations, the fund provider will review them to ensure they comply with IRS regulations and the fund’s guidelines.

Once approved, the provider will distribute the grants to the designated charitable organizations on your behalf.

Some providers offer options for recurring grants or allow you to set a specific grant schedule.

Step 8: Monitor & Manage Your Donor-Advised Fund

Once your Donor-Advised Fund is active, it’s essential to monitor and manage it regularly.

Stay informed about:

- • The fund’s performance.

- • Investment options.

- • Administrative processes.

Many providers offer online portals or tools to track your fund’s balance, grants, and contributions. Take advantage of these resources to ensure your fund aligns with your charitable goals over time.

Setting up a Donor-Advised Fund is a straightforward process that begins with selecting a reputable fund provider.

By following the step-by-step guide outlined above, you can:

- • Establish your Donor-Advised Fund.

- • Maximize your tax benefits.

- • Embark on a philanthropic journey that aligns with your values.

Remember to research your options, evaluate contribution requirements, and actively manage your fund to make a meaningful and lasting impact through charitable giving.

Donor-Advised Funds Rules (2023)

To make the most of your Donor-Advised Fund, it’s crucial to understand the rules associated with these charitable giving vehicles. While the specific rules may vary depending on the fund sponsor, here are some common guidelines:

Donor-Advised Funds vs. Private Foundation

When considering charitable giving options, it’s important to understand the differences between a Donor-Advised Fund and other common vehicles, such as Private Foundations and Charitable Remainder Trusts (CRTs).

Understanding these distinctions will help donors make informed decisions based on their philanthropic goals and preferences.

While both DFAs and Foundations allow you to support charitable causes, there are significant differences to consider:

DAF vs Private Foundation Aspects

| Aspect | Donor-Advised Fund | Private Foundation |

|---|---|---|

| Control | Donors retain advisory privileges over fund recommendations. | Donors have direct control over foundation’s activities. |

| Legal Entity | Not a separate legal entity; managed by a sponsoring organization. | Separate legal entity established by the donor. |

| Grant Recommendations | Donors recommend grants to qualified charities. | Trustees make grants to charitable causes. |

| Payout Requirements | Required to distribute funds annually to qualified charities. | Required to distribute a certain percentage of assets annually. |

| Reporting Obligations | Donor involvement in grant recommendations; administrative reporting. | Higher administrative and reporting responsibilities. |

| Startup Complexity | Generally simpler and faster to establish. | More complex legal and administrative requirements. |

| Tax Deductions | Immediate tax deductions for contributions. | Immediate tax deductions for contributions, similar to DAFs. |

| Overhead and Expenses | Managed by sponsoring organization; may have lower overhead. | Foundation bears administrative costs. |

Donor-Advised Funds vs. Charitable Remainder Trust

Another charitable giving option often compared to Donor-Advised Funds is a Charitable Remainder Trust (CRT).

Here are some key distinctions between the two:

List of Donor-Advised Funds

When considering Donor-Advised Funds, it’s worth exploring a variety of options to find the one that aligns best with your philanthropic goals.

Here are some notable Donor-Advised Fund providers.

Best Donor-Advised Funds

Choosing the best Donor-Advised Fund for your philanthropic goals depends on various factors, including your preferences, investment options, fees, and support services.

Here are a few of the best Donor-Advised Fund providers worth considering:

QCD to Donor-Advised Fund

A Qualified Charitable Distribution (QCD) is a powerful strategy that allows individuals aged 70½ or older to transfer funds directly from their Individual Retirement Account (IRA) to a qualified charitable organization.

While a QCD does not go directly to a Donor-Advised Fund, it can still be a useful tool for those who wish to contribute to a DAF. Let’s explore how a QCD can be utilized in conjunction with a Donor-Advised Fund.

A QCD allows IRA owners to satisfy their required minimum distributions (RMDs) without incurring taxable income on the distributed amount.

The QCD is excluded from taxable income and counts towards the IRA owner’s annual RMD requirement.

However, there are some important considerations when it comes to using a QCD to contribute to a Donor-Advised Fund:

1. Limitations on QCDs

The IRS imposes certain limitations on QCDs. The maximum annual amount eligible for a QCD is $100,000 per taxpayer. This limit applies to the total QCDs made in a calendar year, regardless of the number of charities or Donor-Advised Funds involved.

Learn more about the Benefits of Qualified Charitable Distributions in our comprehensive article! Explore how this strategic approach can help you support your favorite causes while potentially reducing your taxable income.

2. Eligible Recipient

The QCD must be made directly to a qualified charitable organization. A Donor-Advised Fund itself is not considered a qualified charitable organization for QCD purposes.

3. Tax Advantages

By utilizing a QCD, individuals can still achieve tax advantages. The QCD amount is excluded from taxable income, which can be beneficial for those who do not need the funds for personal use and want to support charitable causes instead.

Additionally, if the subsequent grant from the Donor-Advised Fund is made in the same tax year as the QCD, it may further enhance the tax benefits.

4. DAF Grant Flexibility

Once the QCD is made to a qualified charitable organization, individuals can recommend a grant from their Donor-Advised Fund to support specific charities or causes.

Donor-Advised Funds offer flexibility in grant-making, allowing donors to distribute funds to multiple charitable organizations or support a single cause over time.

This flexibility enables individuals to strategically allocate funds from their Donor-Advised Fund based on their charitable priorities and changing needs.

For those who hold an Individual Retirement Account (IRA), there’s an exciting opportunity to channel your retirement funds into charitable gift annuities. Through a qualified charitable distribution (QCD), you can directly transfer funds from your IRA to a charity, which then establishes a charitable gift annuity on your behalf. Note that the current maximum one-time contribution from your IRA is $50,000.

It’s important to consult with a qualified tax advisor or financial professional to fully understand the specific rules and implications of using a QCD to contribute to a Donor-Advised Fund.

They can provide guidance on how to navigate the process, ensure compliance with IRS regulations, and help optimize the tax benefits associated with charitable giving and retirement account distributions.

Next Steps

In conclusion, Donor-Advised Funds offer a convenient and impactful way to support charitable causes. They provide flexibility, immediate tax benefits, and opportunities for multigenerational giving.

But let’s face it, navigating the complex world of Donor-Advised Funds can feel overwhelming.

Don’t worry — at the Convoy of Hope Foundation, we’ve got you covered! We provide a simple, four-step process that makes sure your wealth is maximized for the greatest impact.

Step 1

Meet With

Our Experts

They will work toward understanding your unique giving desires and how to pair those goals with the appropriate financial strategies.

Step 2

Create Custom Giving Roadmap

Our team will create your custom giving roadmap — a detailed plan charting the course to your unique destination.

Step 3

Meet With Your Financial Advisor

Don’t worry, we’ll guide you through this process to ensure you’re confident in your ability to communicate what you want to accomplish.

Step 4

Ongoing

Check-Ins

Your financial plan is a marathon, not a sprint — we’ll provide ongoing check-ins to make sure you’re on track to reach your goals.

Schedule a call today and let’s kick off your journey to becoming a wise giver. Together, let’s make lasting positive change in this world.